Lion Capital

Investment Strategy

Project scrapbook

About our partners

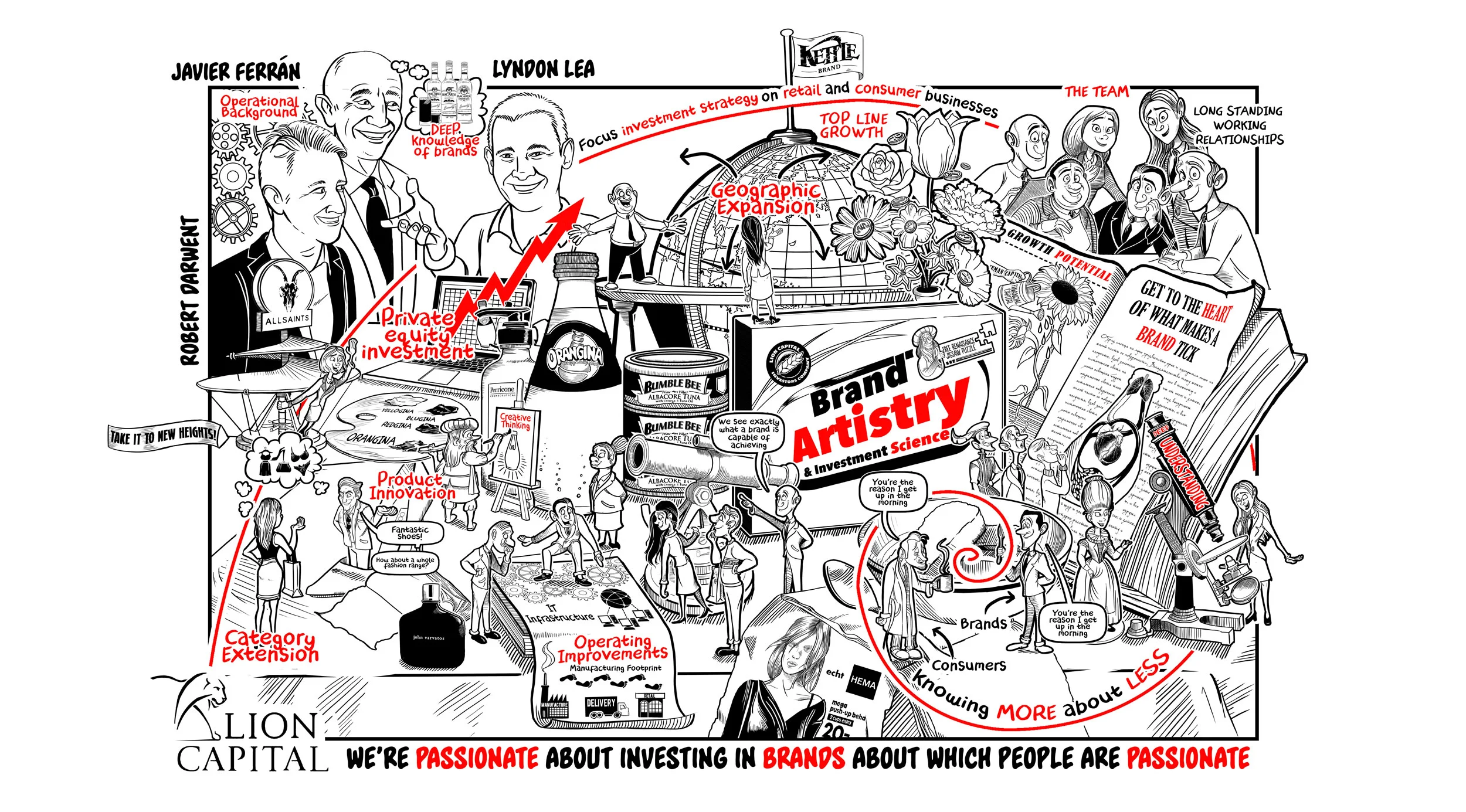

Lion Capital was founded in 2004 by Lyndon Lea, Robert Darwent and Neil Richardson with the goal of creating a leading investment firm focused on the consumer sector. As a private equity company they specialise in the investment of unique & desirable premium brands. Previous and current consumer brands owned by Lion have included Weetabix, Jimmy Choo, wagamama, Kettle Foods and AllSaints.

The challenge

Lion Capital, as is the way in Private Equity, often has to attract potential investors to its fund. To do this they needed a film that conveyed credibility and expressed their unique investment approach.

The film

Lion Capital brands, customers and employees come alive in this film to explore what happens when investment science meets brand artistry. To build credibility we talked through Lion Capital's history. Using the 'golden ratio' we composed a still life of products and brands from the Lion portfolio. These, alongside portraits of the co-founders, tell the story of the business’ origins and paint a picture of their investment strategy. Together the script and illustrations help create an engaging and unique feel; persuading more investors to see Lion Capital as a future Private Equity partner.

The context

Wrisk approached us with a challenge: to distil their cutting-edge platform into an engaging, accessible animation that speaks to diverse audiences—from automotive innovators to insurance professionals.

Whenever someone has a car accident and goes to their insurance company, there’s an upfront cost to pay. But when it comes to car accidents and insurance claims, Claimsline provides a better solution. It saves drivers money and supports them. We worked together to share Claimsline’s service with drivers.

The gap between the super-rich and the rest of us is growing. The Fight Inequality Alliance and Human Act asked us to create an animated explainer video to draw attention to this and the growing inequality crisis during the World Economic Forum 2020.

What if we’re all to a lesser or greater extent subject to modern slavery? A problem that affects many people across the world.

Conceived in the 1960s, the Asian Development Bank are a financial institution who foster economic growth and cooperation. They came to us to create a whiteboard animation sharing the vision behind their new project with their staff.

CCL Compliance specialise in providing regulatory compliance consultancy services to financial services firms from their offices in the UK, UAE and India.

Not all teachers in the United States are covered by Social Security– here’s why.

Lion Capital brands, customers and employees come alive in this film to explore what happens when investment science meets brand artistry.

From its inception, eBay has been contributing to the creation of a less linear model of consumption, the circular economy.

With people living longer that ever before and not saving enough for their later years, is retirement headed for an uncertain future? Money Box explores whether retirement is a thing of the past.

In an age of ‘casino banking’ and irresponsible lending, it's never been more important to return to a system of mutual trust. CSBA believe in rebuilding customer-owned, local banking for Britain.

Looking for a new way to invest your money? This film explains the Innovative Finance ISA in a fun, easy to understand way.